Overpaid Rates Refund Request

Council will write to you if your property is in credit.

If you wish for this credit amount to be refunded, please complete the online “Refund Request” by the due date specified on the letter.

If the “Refund Request” is not received by the due date, the credit will remain on your account and will be applied to the next year’s Rates, Charges and Levies.

The refund will be paid into a bank account in the name of the ratepayer or the owner of the property. If you submit a request for a refund into a bank account in any other name(s), a proof of payment will need to be supplied. This also applies to a refund request for an incorrect payment paid for a property that you do not own.

If you are a conveyancer/solicitor and have been notified that there is a credit on your client’s rate assessment, please notify your client to complete the online “Refund Request” as soon as possible. You can complete the form on your client’s behalf if you attach written authorisation from your client.

To apply for a refund, you will need to refer to the letter and provide the following information:

- Assessment Number

- Property Address

- Name

- Contact Details

- Refund Amount (as stated in the letter)

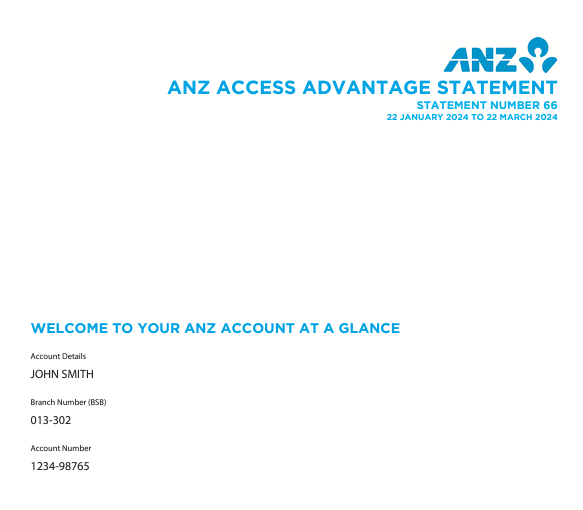

- BSB, Account Name and Number

- Proof of Bank account details(PDF, 93KB) (this is an example only PDF and screenshot below)

Refund Request